Tax and Accounting for Corporation

1. Bookkeeping and Tax Conpliance

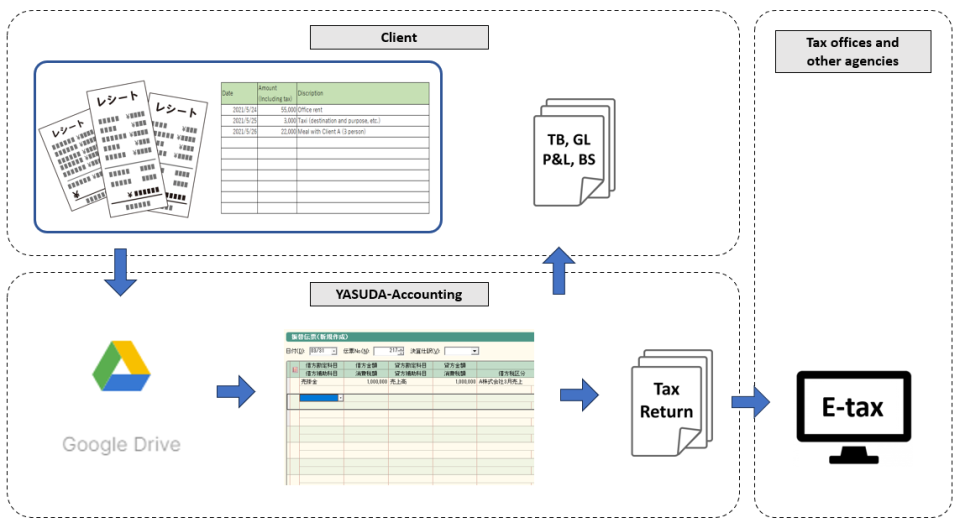

Based on the evidence and information you provide, we will prepare accounting books using our accounting software and provide Trial Balance, General Ledger, P&L and BS to you. We also prepare corporate income tax and consumption tax returns and submit them via e-tax.

You can also ask us at any time with any accounting or tax-related questions, and we will also respond to inquiries or investigations from the tax authorities.

The standard fees are as follows:

| Annual Sales | Monthly bookkeeping fee | Annual tax return fee | Annual Total |

|---|---|---|---|

| Under 25 million yen | 30,000 yen + tax | 150,000 yen + tax | 510,000 yen + tax |

| Under 50 million yen | 40,000 yen + tax | 180,000 yen + tax | 660,000 yen + tax |

| Under 100 million yen | 50,000 yen + tax | 200,000 yen + tax | 800,000 yen + tax |

| Under 200 million yen | 70,000 yen + tax | 250,000 yen + tax | 1,090,000 yen + tax |

| Over 200 million yen | Estimate | Estimate | Estimate |

There are many other factors that affect the exact price. Please contact us and we will provide you with a quote based on your individual case.

2. Reporting package

There are many cases where you need to package and report monthly financial statements and their details to a parent company overseas.

In such cases, we will create your consolidated package in the format specified by the parent company, adjusting and reclassifying accounting standards if necessary.

Our Standard Fee : From 30,000 yen to 100,000 yen per month (excluding tax)

3. Payroll calculation

If a company pays salaries to its directors and employees, it needs to calculate withholding tax and social insurance every month. It also needs to settle withholding tax at the end of the year.

| Number of emploee | Monthly Fee |

|---|---|

| Up to 3 people | 10,000 yen +tax |

| Fourth or more | 2,500 yen + tax per person |

We will also provide separate quotes for various social insurance and labor insurance applications and annual renewal procedures.

4. Year-end Adjustment

| Number of emploee | Annual Fee |

|---|---|

| Up to 3 people | 30,000 yen +tax |

| Fourth or more | 5,000 yen + tax per person |

Quotation and Contract Flow

Please contact us using the inquiry form to describe your situation and the services you require. We will review it and ask any additional questions necessary to prepare a quotation.

During this process, if it is difficult to give you a fixed-price quote smoothly, such as if the situation is complex and it will take time to confirm your tax status, or if your business plan is uncertain and you would like us to do a tax simulation, we may recommend a paid consultation first.

Once we have prepared a quote and you have agreed, we will prepare a contract, which both parties will sign electronically to begin work. Since there is no need to stamp paper, the contract procedure is very smooth.