Taxable person for inheritance tax in Japan

Posted date:2024.09.24 Author:Eisuke Yasuda

Recently, we have been receiving an increasing number of cases related to international inheritance tax.

In cases where the heir or deceased lives or has lived in Japan, or where all or part of the inherited assets is in Japan, even foreigners and non-residents in Japan may be required to declare and pay inheritance tax in Japan.

Determining whether you have a tax liability and the scope of your taxable assets is quite complicated. This article will explain it in detail. The valuation of inherited assets and the calculation of inheritance tax are also complicated, but we will explain those in another article.

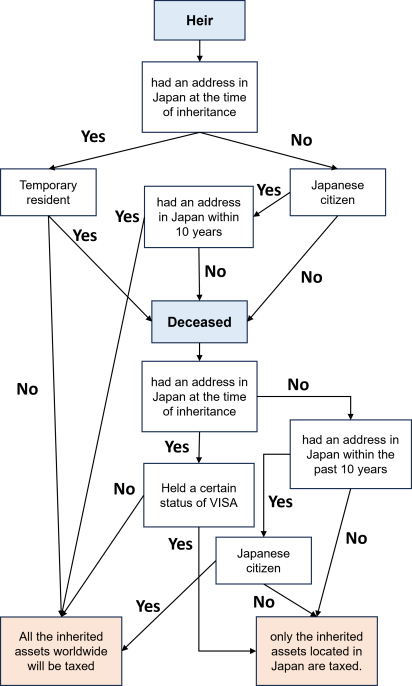

The diagram below gives an overall picture of whether or not you have a tax liability and the scope of taxable assets.

It is also important to note that the concept of “having an address in Japan” used in the context of inheritance tax is different from the definition of resident or non-resident for income tax as explained below.

Resident of Japan (excluding temporary resident)

If an heir have an address in Japan at the time of inheritance, in principle, all inherited assets worldwide are subject to tax. It does not matter whether the heir are a Japanese citizen or not, nor does it matter the nationality or past residence in Japan of the deceased. However, if the heir is a temporary resident, there are exceptions, as explained below.

Temporary resident of Japan

Temporary resident refers to a person who had an address in Japan for a total of ten years or less within the last 15 years before the death of the deceased, and holds a “Table 1 visa” defined in the Immigration Control and Refugee Recognition Act.

If the heir is a temporary resident, in principle the inherited assets worldwide are subject to tax. However, depending on the status of the deceased, specifically in the following cases, only the inherited assets located in Japan are taxed.

- When the deceased is a foreigner with an address in Japan and held a “Table 1 visa” defined in the Immigration Control and Refugee Recognition Act at the time of death.

- The deceased had an address in Japan within 10 years prior to his/her death, and did not have Japanese nationality during the period that he/she had an address in Japan.

- The deceased had no address in Japan within 10 years prior to his/her death.

Non-resident of Japan

If an heir does not have an address in Japan at the time of the inheritance, but has Japanese nationality and has had a residence in Japan within the past 10 years, the inherited assets worldwide will be taxed.

If an heir does not have an address in Japan at the time of the inheritance, and does not have Japanese nationality, the determination of the deceased will be made in the same way as for temporary residents above as well.