Income Tax filing obligations of foreigners in Japan

Posted date:2023.08.09 Author:Eisuke Yasuda

Income taxpayers in Japan

Regarding the taxation of income tax in Japan, whether your nationality is a Japanese or foreigner does not matter much except for some regulations, and the actual situation of living in Japan will be the criteria for judgment. This article will focus on income tax issues that foreigners in Japan are likely to face.

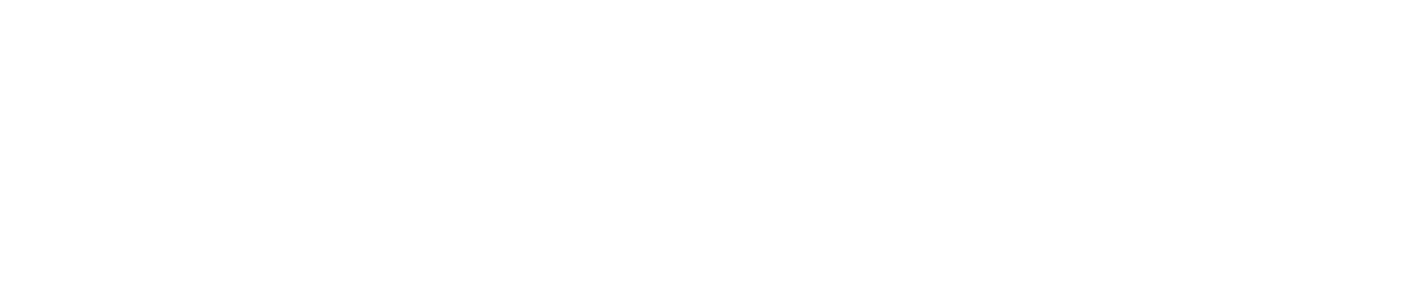

The Japanese Income Tax Law divides all individuals into residents and non-residents, and further divides residents into permanent residents and non-permanent residents. Each definition is as follows.

- Resident is any individual who has a domicile or owns residence in Japan continuously for one year or more.

- – Non-permanent resident is a foreign national who has had a domicile or a residence in Japan for a total of five years or less within the past ten years.

- – Non-resident is an individual who is not a resident.

- – Domicile (住所) refers to the place where a person lives

- – Residence (居所) refers to a place where he/she resides continuously for a considerable period of time, although it is not the base of his/her life.

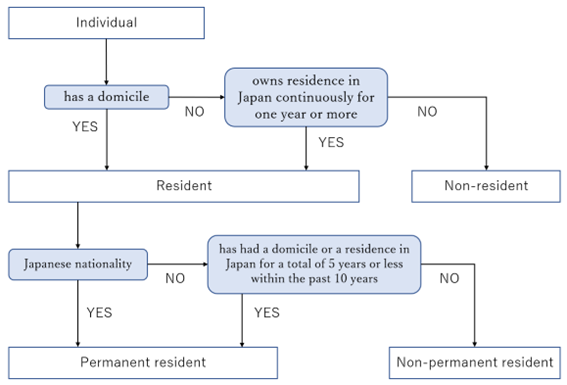

Different taxable scopes and taxation methods are defined according to each category.

The scope of taxable income

- Permanent residents are taxed on all income earned worldwide, including foreign-sourced income.

- For non-permanent residents, in addition to domestic source income, the portion of foreign source income paid in Japan or remitted to Japan from abroad is subject to taxation.

- Non-residents are taxed only on domestic source income.

Domestic source income

Regarding the taxation of non-residents, the type and scope of domestic source income becomes important. The types of domestic source income are listed in Article 161 of the Income Tax Law as follows:

- Income attributable to a permanent establishment.

- Income from the utilization or possession assets located in Japan.

- Income from the transfer of assets located in Japan.

- Certain distributions derived from the profits of a business conducted through a permanent establishment based on a partnership contract and received in accordance with the provisions therein.

- Income from sale or disposal of land, rights established on land, buildings, and facilities attached to buildings, or structures in Japan.

- Income received as compensation by business operators providing personal services in Japan, including compensation for services provided by motion picture artistes, musicians and any other entertainers, professional athletes, lawyers, accountants, and other professionals, or persons possessing scientific, technical, or managerial expertise or skills.

- Rent or other compensation for the use or lease of real estate in Japan and rights therein or established thereon.

- Interest on national and local government bonds and debentures issued by domestic corporations; interest on debentures issued by foreign corporations that is attributable to business conducted through a permanent establishment; interest on savings deposited to entities located in Japan, etc.

- Dividends on surplus, dividends of profits, distribution of surpluses received, etc. from domestic corporations.

- Interest on loans that are provided for business operators for their business conducted in Japan.

- Royalties or proceeds from the sale of industrial property rights and copyrights, and rental charges on equipment that are received from business operators for their business conducted in Japan.

- Salaries, bonuses, or compensation for the provision of personal services resulting from employment and other personal services provided in Japan; and public pensions and severance allowances derived from employment, etc. offered during the resident taxpayer period.

- Monetary awards for the advertisement of a business conducted in Japan.

- Pensions, etc. based on life insurance contracts concluded through entities located in Japan.

- Money for payment for installment savings accounts, etc. received by entities located in Japan.

- Distributions of profits based on silent partnership arrangements, etc. for contributing capital to a business operating in Japan.

- Other domestic source income including that concerning insurance benefits and compensations for damages received in conjunction with business conducted in Japan or assets located in Japan.

Individual income tax return filing

Income tax return is a procedure for taxpayers to calculate the amount of income for the year and the corresponding amount of income tax and submit a final return to the tax office. If you are taxable based on the judgment above, you may or may not have to file a tax return. In the following cases, there is a tax return obligation.

- A person whose salary income for the year exceeds 20 million yen.

- A person who receives salary payment from one place, and the total amount of income other than employment income and retirement income exceeds 200,000 yen.

- A person who receives salary payments from two or more places and whose total salary income other than the main salary exceeds 200,000 yen.

Therefore, in many cases, people who receive salary from only one company, have no other income, and whose annual income is 20 million yen or less do not need to file a tax return. Tax payments are completed with monthly withholding and year-end adjustments (Nenmatsu chosei) made by the company.

Also, even if the above case is not applicable and there is no tax return obligation, there are cases where a tax return will result in a refund, in which case it should be filed. Specifically, this is the case when there are deductions that are not subject to the company’s year-end adjustments, such as medical deductions and hometown tax donation program (Furusato nozei).

Examples of people who are obliged to file income tax returns

- A foreigner living in Japan, employed by a Japanese company, earning 25 million yen in annual salary.

- A foreigner who is a permanent resident of Japan, employed by a Japanese company, earns an annual salary of 8 million yen, and has a rental income of 2 million yen from overseas real estate. In this case, you may be eligible for a foreign tax credit.

- A non-resident of Japan with an annual rental income of 3 million yen from real estate in Japan.

- A resident of Japan who earns business income as a sole proprietor with an annual income of 15 million yen.

These are just a few examples of those who are required to declare.

Please contact our experts for more information

While the above overview is useful enough, the actual calculation of the tax amount and filling out the tax return is much more complicated. We recommend that you consult with a specialist if necessary. YASUDA-Accounting has extensive experience in providing accounting and tax services to foreign companies and foreign nationals, as well as English-language services. Please feel free to contact us for more information.