Exemption for Dependent Relatives Residing Abroad

Posted date:2022.10.29 Author:Eisuke Yasuda

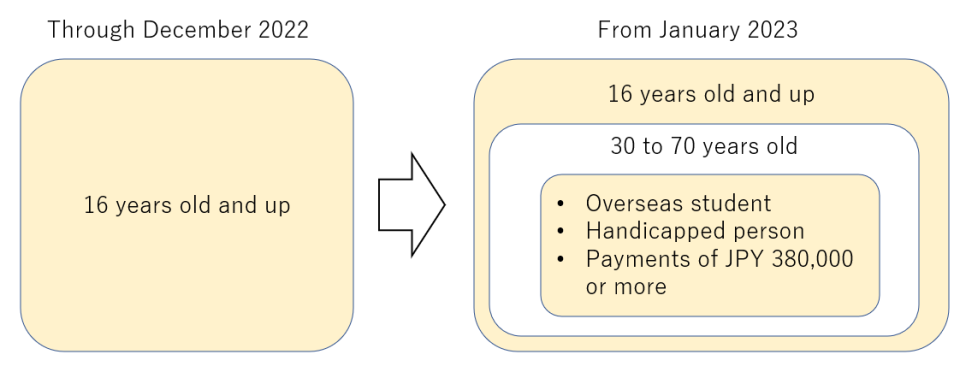

Effective January 2023, the overseas resident relative who is eligible for the deduction for dependents is limited to those who fall into one of the following three categories among the dependents. “Dependents” are defined as relatives of a Japanese resident whose total income is 480,000 yen or less.

- Persons between the ages of 16 and 30.

- Those who are 70 years of age or older.

- Those between the ages of 30 and 70 who fall under any of the following.

- Those who no longer have a domicile or residence in Japan due to studying abroad.

- Persons with disabilities.

- Those who receive payment of JPY 380,000 or more from the resident to cover living expenses or educational expenses during the year.

Until 2022, there was no specific limit on the amount of remittance, but please note that starting in 2023, if your dependent meets the age requirement, you must remit at least 380,000 yen and provide evidence of the remittance to be allowed.